In the next decade, major upgrades are expected for the U.S. dollar bills, driven by the need for improved security features, a potential shift toward digital currencies, and responses to evolving economic demands. Currency is continually evolving, with regular design upgrades aimed at enhancing security, functionality, and aesthetic appeal. Over the years, we’ve seen shifts in the way currency looks and operates, from changes in paper bills to the introduction of digital currencies. As technology advances and counterfeit risks grow, these updates are essential to maintain the integrity of financial systems.

Currency changes are important to combat counterfeit money

Currency changes are crucial in the ongoing battle against counterfeit money. As technology advances, so too do the methods used by criminals to replicate currency which makes it increasingly difficult to distinguish fake bills from real ones. To stay ahead of these threats, governments and central banks regularly update currency designs by incorporating sophisticated security features such as holograms, watermarks, and color-shifting inks.

These innovations make it harder for counterfeiters to produce convincing replicas and help ensure the integrity of the financial system. Regular updates to currency are an essential measure to protect economies from the damaging effects of counterfeit money, maintaining public trust in the value of legal tender. Within the next decade, major upgrades are expected across all dollar bills to continue the fight against inflation.

Accessibility a major vocal point of recent expectant currency changes

The call for accessible currency was recently highlighted during an advocacy event on Harriet Tubman Day, an annual observance on March 10 honoring the legacy of anti-slavery activist Harriet Tubman. Disability activists and their supporters gathered at the “Show Me the Money: Marching Together for Accessible and Inclusive Currency” event in front of the White House. Among the speakers were leaders from the American Council of the Blind (ACB), who emphasized the need for inclusive modifications to the nation’s currency to ensure accessibility for all.

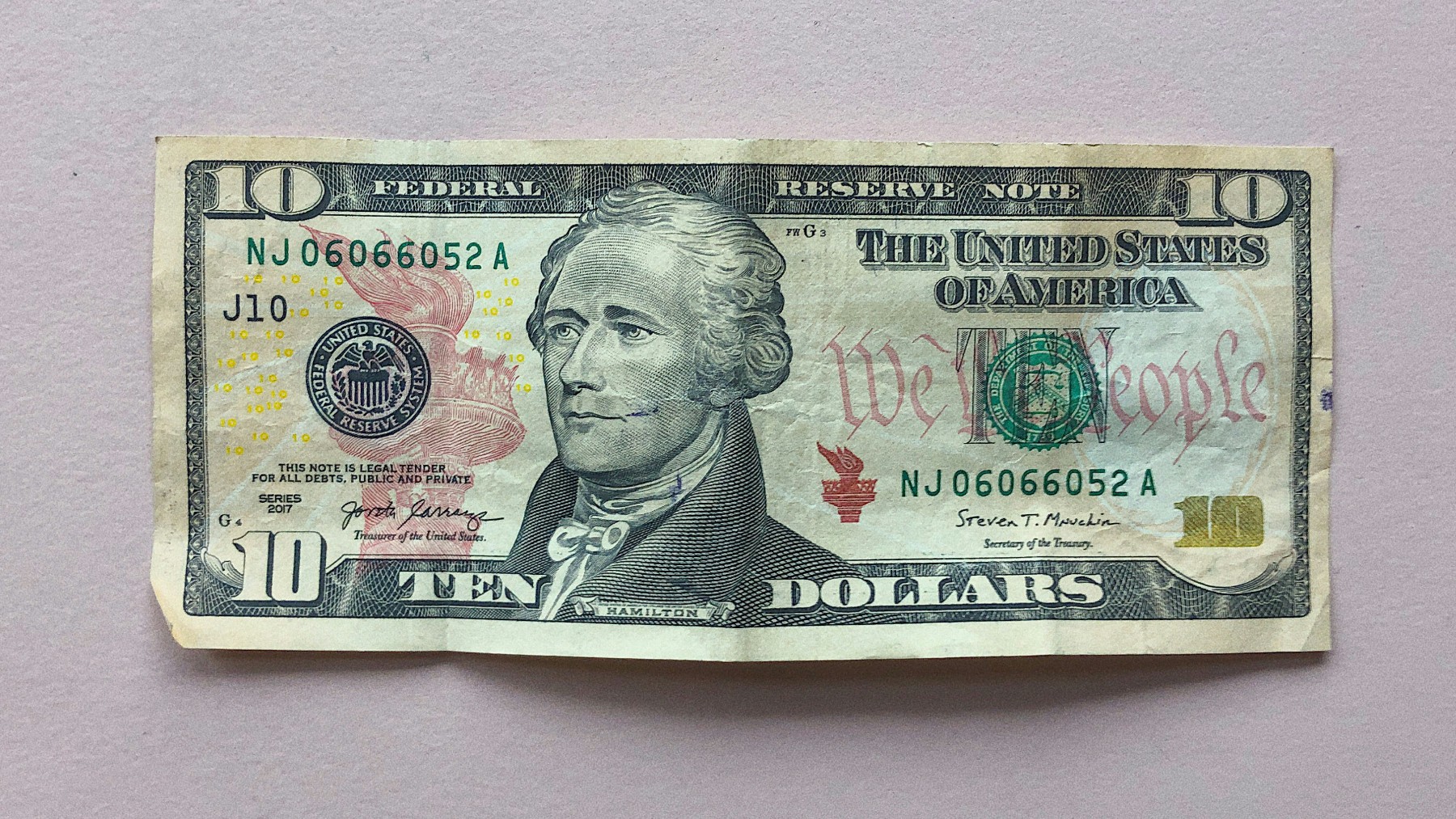

A recent win this year for accessibility advocacy groups is a new upgraded expected to come for the currency by 2026. Following the recent rally on Harriet Tubman Day, five members of the American Council of the Blind (ACB) met with representatives from the U.S. Treasury and the Bureau of Engraving and Printing. For the first time, a certified tactile feature that will be incorporated into the redesigned $10 bill. Despite a 2008 Federal Court Order requiring that all new currency redesigns include accommodations for individuals who are blind or have low vision, activists argue that this is consistently not being met.

Major win, but is cash still necessary?

The recent strides in making currency more accessible for individuals who are blind or have low vision are a significant win for inclusion, ensuring that all people can more easily engage with and use money. However, the role of physical cash in everyday transactions is becoming an increasingly debated issue in an era dominated by online and digital banking.

With more consumers turning to mobile payments, credit cards, and cryptocurrencies, the demand for cash is steadily declining. This shift raises questions about the future of physical currency, its circulation, and its relevance in a digital-first world. While accessibility improvements for traditional money are important, the broader trend toward digital financial solutions may eventually make physical cash less central to daily life, posing challenges for its continued circulation and use.

Online banking has the potential to be more inclusive for people with disabilities, offering a range of features that can be tailored to individual needs. For example, many online banking platforms include screen reader compatibility, voice commands, and customizable font sizes, which can assist individuals with visual impairments. The convenience of online banking also eliminates the need to visit physical bank branches, which may not always be fully accessible.