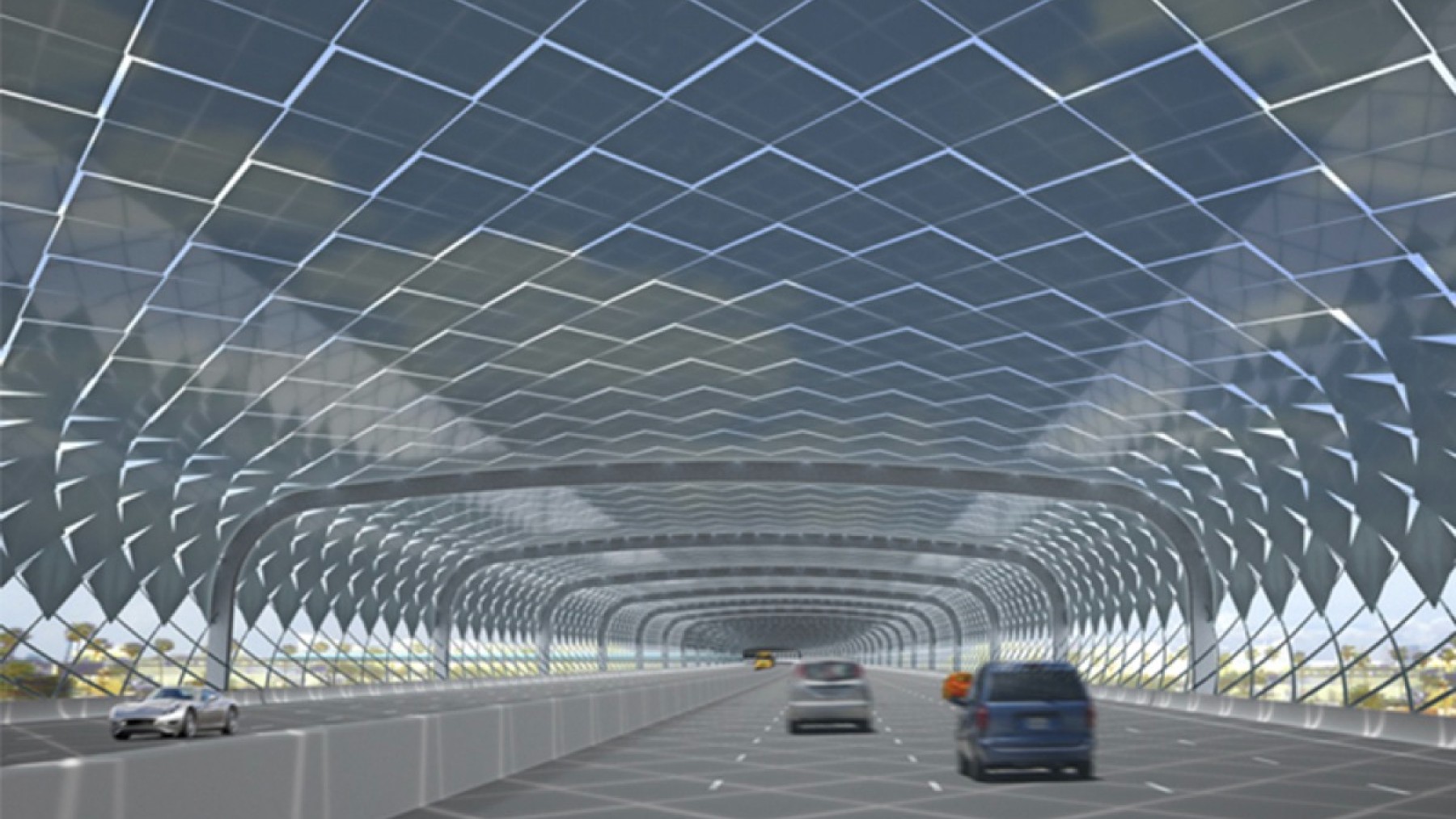

The United States China trade fight that is raging – and intensifying by the minute – has just entered a new chapter. One of the consequences we feared most has just come to pass, and now has the industry in chaos. Carmakers are going through a time of uncertainty because of our Asian rival, and the whole country is on edge. Setback in sustainable mobility? Everything seems to point to that.

The U.S.-China trade war reaches a new sector: there are concerns

The ongoing U.S.-China trade war that began in 2018 has had major consequences across industries, as each country has aimed tariffs at the other’s exports. Among the industries caught in the crosshairs of the escalating trade tensions is automotive manufacturing.

Both U.S. and Chinese automakers have faced challenges as each country has targeted tariffs at the other’s car exports. The U.S. put tariffs on Chinese vehicle imports, aiming to boost domestic manufacturing. But this has led to some unintended ripple effects hurting American automakers as well.

The problem that our country has now is not precisely in our borders, but in Europe and Latin America, where Chinese brands are arriving. This could generate a chain effect that translates into Tesla being displaced as the electric car brand par excellence, something that everyone fears.

U.S. reaction to protect its industry: premature and unsuccessful

The Trump administration implemented tariffs on auto parts imported from China starting in 2018. This significantly raised manufacturing costs for U.S. automakers that rely on Chinese suppliers for many components. The memorandum of understanding that the two countries signed was not even a glimmer of success.

With tariffs as high as 27.5% on Chinese auto parts, companies like Ford and GM saw expenses climb. They had to choose between absorbing the higher costs or passing them on to consumers through increased vehicle prices. Most manufacturers opted to take a hit on margins to remain competitive on pricing.

Either way, the tariffs squeezed profits. Some analysts estimated the annual cost at around $1 billion for major American automakers. With thin profit margins in the auto industry, these extra tariff costs directly impacted the bottom line.

This unexpected consequence put U.S. car companies at a disadvantage. While trying to compete globally, they faced rising expenses from trade policy. This made American automakers less competitive relative to rivals without these added costs.

What could happen next: car makers keep an eye on these forecasts

The trade war resulted in China imposing retaliatory tariffs on U.S. car imports. This significantly reduced the number of cars exported from the U.S. to China. Similarly, brands such as BYD are not present in our country, except for some imported vehicles that belong to the luxury segment.

In 2018, prior to the start of the trade war, about 262,000 U.S. manufactured vehicles were shipped to China, representing a large and lucrative export market. However, once the tit-for-tat tariffs began, exports plunged. By 2020, only around 56,000 American cars were exported to China annually.

Major U.S. automakers were hit hard by the loss of access to this key overseas market. Brands like Ford and Tesla saw exports to China essentially evaporate once the tariffs made their vehicles far more expensive for Chinese consumers. This contributed to declining sales and profits.

The U.S. auto industry had invested heavily in China, viewing it as a market with huge potential for growth. But the trade war severely disrupted these ambitions. American car companies were essentially locked out just as the Chinese auto market was starting to boom.

As you can see, the United States China trade fight is having unexpected and increasingly serious consequences. You also saw it last week with the international lawsuit that the Asian country filed to keep IRA funds. However, it now seems to be showing a new face that we would not like to face, although the cost will not only be ecological, but also economic and even temporary (because of the years we will go back).