United States federal government has just approved the new Residential and Microturbine System Tax Credit, just what you were looking for in order to improve your energy efficiency at home. Maybe renewables are the best option to save money and adopt a better way to live… and obtain up to 30 % of the installation cost, of course.

The IRA includes a new tax credit: pay attention to microturbines systems

The Inflation Reduction Act of 2022 —as we have seen with other public subsidies— includes a new 30% tax credit for homeowners who install qualifying microturbine energy systems. This tax credit aims to incentivize homeowners to adopt renewable energy systems and reduce reliance on fossil fuels.

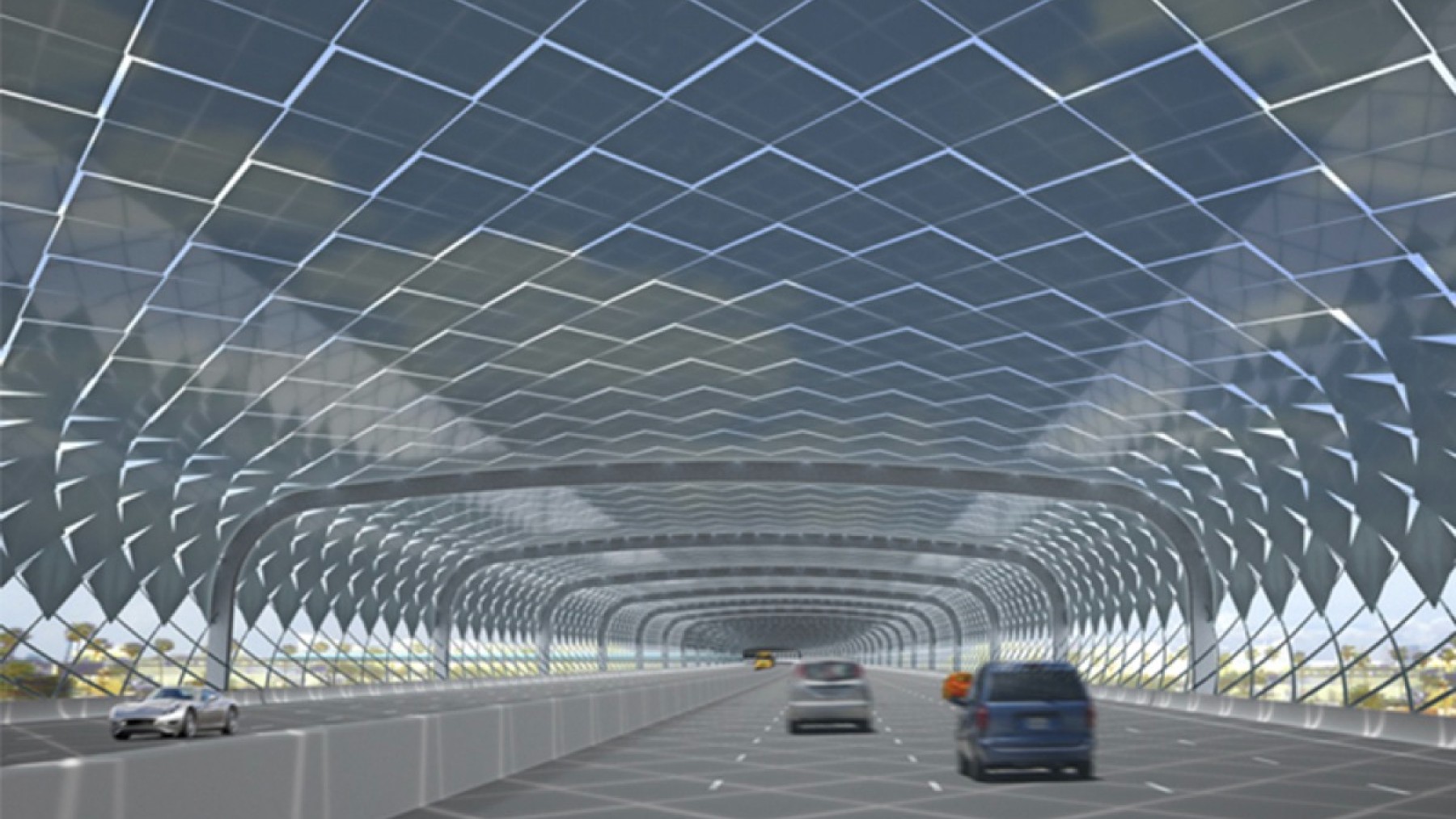

Microturbines are small electricity generators that burn gaseous or liquid fuels, such as natural gas, propane, diesel or kerosene, to create high-speed rotation that turns an electrical generator. The new tax credit applies specifically to microturbine systems with a nameplate capacity of less than 200 kilowatts.

The 30% tax credit allows homeowners to deduct 30% of the total installed cost of a qualifying residential microturbine system from their federal income taxes. This incentive can help offset the upfront investment for homeowners interested in installing microturbine power generation.

The Residential and Microturbine System Tax Credit, at detail

The microturbine tax credit is a federal tax credit that allows homeowners to receive up to 30% of the cost of installing a qualified fuel cell power system in their primary residence. This tax credit was created to incentivize homeowners to utilize clean energy technologies like fuel cells.

As you may know, this system has minimal environmental impact compared to traditional energy sources. Homeowners interested in achieving energy independence, reducing environmental impact, and saving money on installation costs should consider whether installing an eligible fuel cell system in their home makes sense.

The 30% tax credit applies specifically to fuel cell systems, not other types of microturbines. Fuel cell systems generate electricity through an electrochemical reaction, not combustion, making them very clean and quiet. The fuel cell must have a nameplate capacity of at least 0.5 kW to qualify.

Homeowners can potentially save thousands of dollars in installation costs by taking advantage of this tax credit. For example, if a fuel cell system costs $20,000 to install, the homeowner would receive a $6,000 federal tax credit. This can make fuel cell systems much more affordable and attractive to homeowners looking to go green.

Who qualifies for this tax credit? The requirements, unveiled by the government

The residential microturbine tax credit is available to homeowners who install a qualified microturbine system on their primary residence. To qualify, the microturbine system must generate electricity and meet specific efficiency standards, as they have been published by the government.

The tax credit applies to microturbine systems placed into service between January 1, 2022 and December 31, 2032. Both existing homes and new construction qualify. The home served by the microturbine system must be located in the United States and be the taxpayer’s main home.

Rental properties do not qualify for the residential microturbine tax credit. The credit is only for systems installed on a primary residence. However, businesses may be eligible for a different tax credit for commercial microturbine systems.

To receive the full 30% tax credit:

- The microturbine system must have a minimum efficiency of 26% for systems ≤ 100 kW.

- Systems > 100 kW must have a minimum efficiency of 28%.

- Lower efficiency systems may qualify for a reduced tax credit amount.

Homeowners do not need to itemize deductions to claim the residential microturbine tax credit. The credit directly reduces taxes owed and can be carried forward into future tax years. Homeowners should keep receipts and certification paperwork to document their qualified system.

It is clear that new Residential and Microturbine System Tax Credit is an opportunity for you to obtain up to 30 % of the installation cost and improve you energy efficiency at home. This is one of the non-directly supported by IRA programs, what means that you can benefit from it until the year 2032.