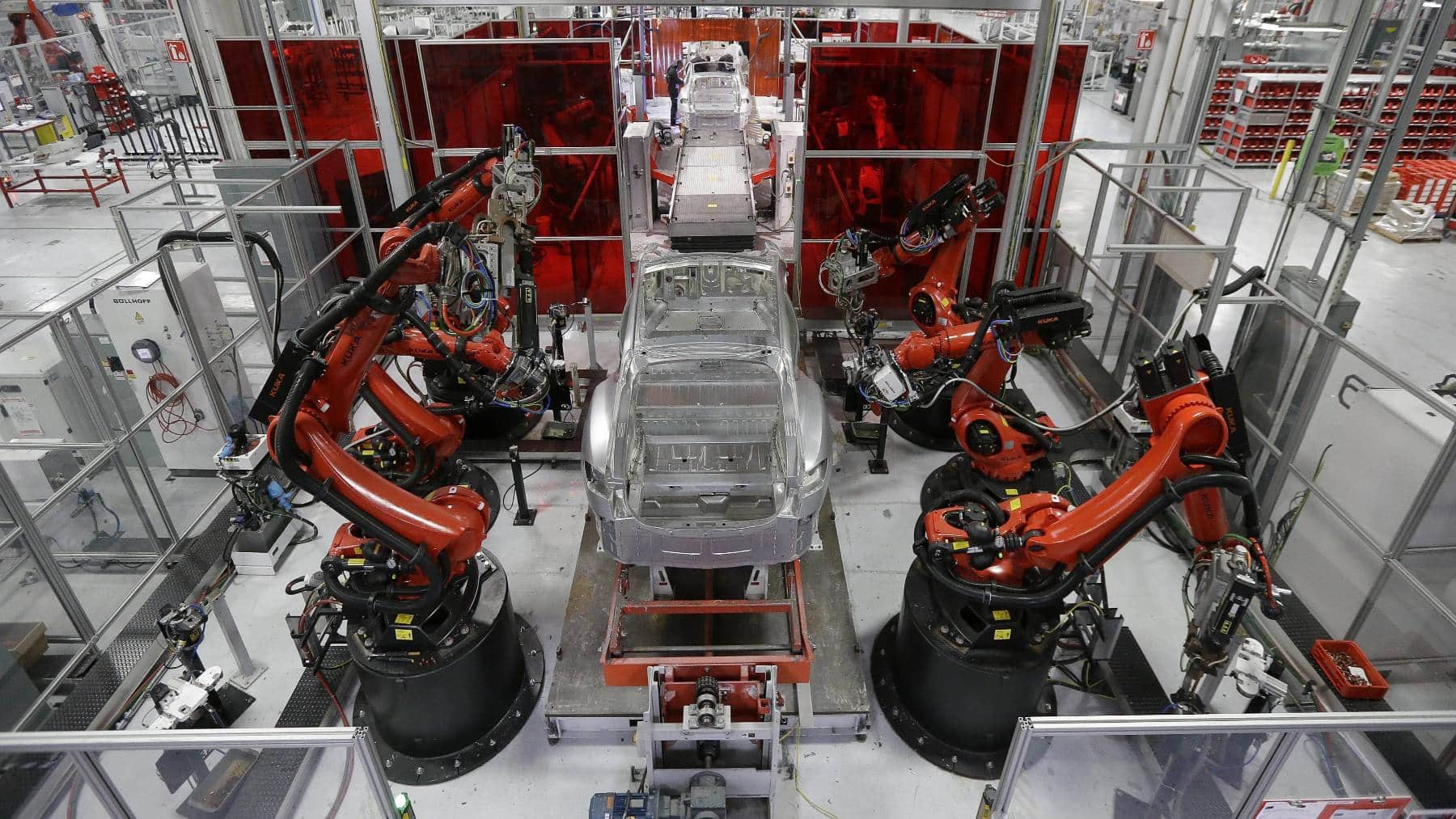

Tesla’s recent acquisition of insolvent German engineering company Manz AG sent industry leaders buzzing and whispering about it. The takeover is being hailed as a milestone in Tesla’s manufacturing ramp plans. As Tesla ramps up manufacturing capacities, adding cutting-edge automated solutions will bolster its competitive advantage in the EV market. Let us examine how this takeover will affect Tesla and its implications.

Tesla’s latest big buy: here’s why Manz AG is a game-changer

Tesla Automation GmbH, a German subsidiary of Tesla Inc., agreed to purchase insolvent core assets of core German automated solutions provider Manz AG. The takeover includes buying out more than 300 employees and moveables at the Reutlingen plant of Manz. The takeover will add Tesla’s expertise in advanced mechanical engineering and automation and consolidate leadership in advanced manufacturing solutions.

Manz AG, which deals in automation, laser cutting, metrology, wet chemistry, and roll cutting, requested insolvency in December 2024. The takeover is being termed a rescue for the company since it would still operate as a Tesla company. However, nearly 100 employees at Manz are not moving to Tesla Automation following the takeover. The employees would be allowed to move to a transshipment company to neutralize the social disadvantage of losing jobs.

This acquisition is significant as Manz was key in designing automated manufacturing solutions. Tesla constantly requires manufacturing processes to be optimized, and Manz’s expertise and technology(read more surprising news from Tesla) can be invaluable in making manufacturing lines efficient, reducing costs, and streamlining output in Tesla’s gigafactories.

The acquisition is a strategic move for Tesla since it favors automated capacities. The company is looking to be able to complement Tesla’s recent move towards streamlining its manufacturing workflow. In recent years, Tesla has taken investing in automation seriously in a move towards weaning away from relying on human employees, and this purchase buys trained employees and advanced automated machinery in place to achieve just that vision.

What Tesla gains: faster production, lower costs, and more innovation

Lothar Thommes, Managing Director at Tesla Automation, is upbeat about the takeover and outlines, “We are adding highly trained staff who have a wealth of experience in state-of-the-art mechanical engineering.” The Reutlingen plant is a suitable fit for Tesla’s globally active automation solutions. He emphasizes that Tesla is excited about starting future innovations at this plant.

Beyond automation, this takeover would have extensive implications for Tesla’s battery manufacturing. As manufacturing is Tesla’s expertise, merging with Manz technology would equate to energy breakthroughs in efficiency, battery lifespan, and output in general. As Tesla ramps manufacturing in larger numbers, these breakthroughs will be pivotal in sustaining its sustainable plan for future advancement.

The integration of Manz technology and capability is expected to significantly impact Tesla’s manufacturing capability. Tesla is interested in bringing cutting-edge automated manufacturing technology to Manz to reduce manufacturing costs and streamline manufacturing processes. The move aligns with highly automated manufacturing processes, or “the machine makes the machine.”

What could go wrong? The hurdles Tesla must overcome first

While Tesla’s purchase of Manz AG is fraught with potential, there are also some obstacles. Merging a bankrupt company like Tesla is no easy feat and must be planned and implemented methodically. Tesla must be sure it incorporates Manz’s technology without interrupting current manufacturing or introducing inefficiencies in the form of slowing down procedures.

Additionally, the German Federal Cartel Office approval in line with merger control is awaiting approval. It is possible to be in a position to hold back closing out the purchase as a direct outcome. It is possible for foreign market approval to be problematic in some way, and approval delays may impact Tesla’s short-term manufacturing plans.

Despite these hindrances, Tesla’s prospects are favorable. The acquisition of Manz AG should cement Tesla’s move towards highly automated manufacturing. This transformation should enhance Tesla’s (related news from Elon Musk’s Tesla) ability to innovate and quickly introduce products. It should greatly enhance Tesla’s manufacturing capability and productivity if properly implemented.