House Bill 277, presented by Rep. Katy Hall, R-Weber/Davis, proposes revolutionary financial advantages to car owners through state vehicle registration procedure modifications, which the Utah State Legislature plans to authorize. Through bill HB 277, homeowners in Utah will obtain fee reimbursement for unused vehicle registration. The passage of this legislation would cause the state to shift its practices regarding vehicle registration taxes and policies.

Double taxation on vehicle registration? This bill aims to fix it.

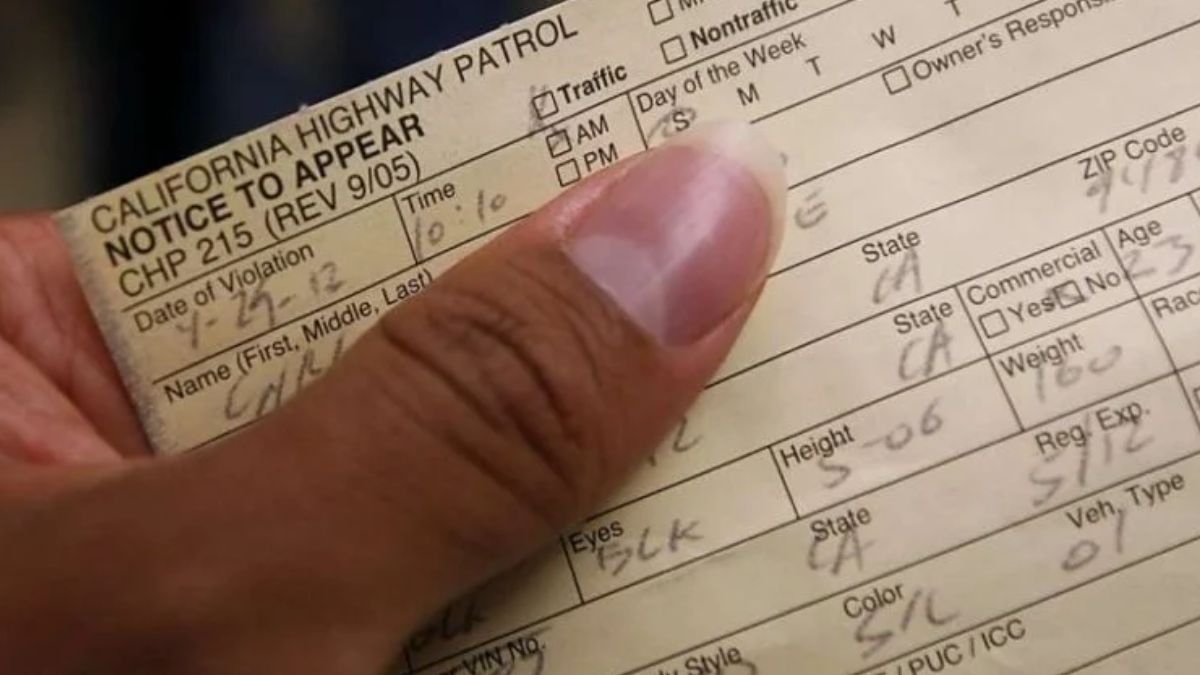

House Bill 277 is the legislative vehicle that addresses dual taxation problems in vehicle registration services. Vehicle owners must pay twice after selling their vehicles because they need to register their new vehicles within the same time frame after the sale. People who own vehicles experience avoidable financial burdens from the current approach, which challenges the reasonableness of fee distribution methods.

Under current law, a solution exists because original owners can use online tools to end vehicle registration and receive a complete refund for unused days within the annual period. Vehicle owners will avoid additional fees for registration either during a vehicle sale or if their vehicle becomes unfit for use.

During their interview, Katy Hall explained to Dave and Dujanovic how double taxation issues drove her to introduce the bill. The current method of vehicle registration requires duplicate ownership payments from drivers each time a vehicle’s ownership changes hands during purchase. Vehicle owners will now pay registration fees to state authorities under new state laws specifically covering the period their vehicles remain in use.

Under this new law, adults can wave goodbye to unapproved out-of-state vehicle registrations

The existing policy enables tax fee collection twice when customers transfer vehicle ownership between registration periods. Vehicle registration (similar article on vehicle registration) fees are collected when car owners initially sign up before selling to different owners. Many Utah automotive owners found House Bill 277 to solve their double registration fee payments.

The new legislation lets motorists get money back after terminating their registration periods to avoid paying registration fees twice. According to the law, residents cannot export their vehicles outside Utah to circumvent sales taxes. Resident vehicle owners who exit registration periods can access refunds from this system, which motivates them to manage their vehicle registrations within Utah.

Representative Katy Hall supports the provision because it solves the registration problem. Citizens throughout Utah do not have any valid justifications to avoid their responsibilities. The legal provision enables anyone who avoids annual registration usage to obtain reimbursement payments. The refund provision is critical because it addresses continuous tax losses occurring in Utah. Vehicle registration in Utah has become more efficient for the state government thanks to bill conditions, which ensure proper tax revenue collection.

The future development and subsequent actions following the legislative process

The decision on House Bill 277 rests with the Senate committee members because the Utah House has already passed the bill. The proposed bill aims to change Utah vehicle registration rules by introducing cheaper costs and maintaining equal standards across the ownership community. Members of vehicle ownership groups and policymakers monitor the legislative expansion of this proposed bill. If this proposed legislation successfully passes the legislative process, car owners state-wide will receive full tax equality and financial advantages.

House Bill 277 propulsion will lead to better vehicle registration practices for Utah residents that represent equitable solutions. House Bill 277 sets a practical measure against double taxation by removing unnecessary fees and triggering refunds for non-registrations of motor vehicles ( Should also check on this legislative action) during their allotted registration period. This new law will establish essential changes that offer advantages to Utah citizens who own vehicles nationwide.

House Bill 277 eliminates surplus expenses to build a just and open car registration system, easing financial burdens for Utah citizens. The bill’s established administrative system makes vehicle registration responsibilities for Utah residents less complicated. According to the new reform, economic fairness and enhanced state policy transparency allow for an accountable and efficient system. House Bill 277 establishes fundamental improvements, such as an equitable, user-friendly vehicle registration framework that benefits Utahans while advancing state governance principles.